Chain Knowledge - Invention - Technology - Wealth (KITWE)

A System Dynamics Based Model

Luciano Gallón

l.gallon@ieee.org

The objective of this work is to develop a model for a dynamic system and to simulate its behavior by means of the use of software in order to advance in the understanding of two subjects of research related to the complexity of knowledge management and technology management based on its direct or indirect consequences in the integral wealth of the individual or the organization.

First, which would be a basic systemic and dynamic model of the system made up of the elements: Knowledge, Invention, Technology and Wealth (which will be denominated KITWe Chain), and second, what behavior can be obtained from the elements of the model so that the characteristics, relationships, causes and consequences of the management decisions associated to the intervention of the surroundings and projects of knowledge or technology that modify the behavior of the wealth can be better included or understood. From another point of view, it is looked for a model that helps to understand and to predict failures and successes in technology projects.

This work presents an original approach to a systemic model of the KITWe chain. It proposes definitions for the Knowledge, Technology, Invention, Innovation and Wealth concepts as reference for the reader, and understands the technology in the most complex and interlaced possible way, locating it much beyond the simple technical object and conferring it an ample social surrounding.

Given the challenge to construct this first simplified model with which the complex system of the KITWe chain can be simulated by means of software tools, it is made a simple and clear proposal for ten work parameters that allow to delimit the surroundings of analysis and synthesis of the input and output premises. This way it is supposed the simulation time interval, it is determined the fundamental question that the model must respond, it is indicated what will be observed of the model, the innovation is located as an element that is part of the complexity of the chain, it is set out five constituent elements for the wealth, it is indicated what units will be used, it is defined the context of data and information of the model and it is defined the level, auxiliary and flow variables.

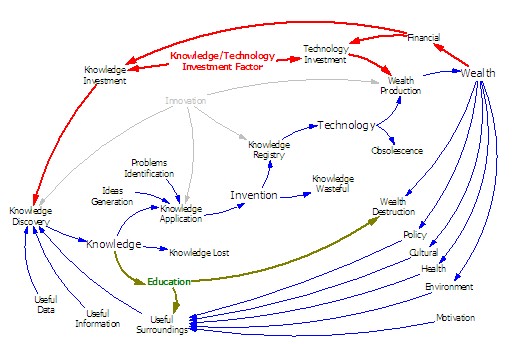

Following System Dynamics methodology, and from the proposal of work parameters, the causal model of the KITWe chain is constructed in the first place as is shown in Figure 1.

Figure 1. The KITWe Chain causal diagram to simulate its dynamic behavior.

Next is the formulation of the equations that will be entered in the software tool. With the raised model it is necessary to altogether determine a set of thirty two equations that will appear in the final paper as a reference.

With the causal diagram of the software model and with the equations, it is come to construct the Forrester diagram and thus to the simulation stage, oriented to respond the defined fundamental question, that is to say, how the wealth behaves depending on the relation between investment in knowledge and investment in technology?

Two extreme simulations are made, one for levels of investment with a Factor of Knowledge_Investment/Technology_Investment of 0.1 and another one for levels of investment with a Factor of Knowledge_Investment/Technology_Investment of 0.9.

With the presentation of the simulations of the model for the proposed extreme conditions one goes to the final stage of the work as a discussion in which it is indicated:

How it was arrived at a coherent final model and how were surpassed several problems as the complexity capture using system dynamics models, the determination of adjustments of the variables and how to obtain that they represent realistic and coherent ranks, and the existence or not of feedbacks between the elements of the chain.

What tendencies were defined and used for the different variables.

What problems and advantages appeared with the units defined for the variables.

What feedback was received and what corrections were made to the model after their presentation to a system dynamics discussion group.

Finally and as conclusions, these among others more:

The model shows first results that confirm the hypothesis that investing without a careful balance in knowledge and technology leads to serious consequences with the wealth. Is observed that with a surcharge towards the investment in technology a very early gold stage is had that leads finally to the catastrophe, however, with a surcharge towards the investment in knowledge a slow stage of growth is had that leads finally to an accelerated and virtuous growth of all the levels of the wealth.

The system dynamics modeling using the Forrester process is a supreme valuable tool for approaching to complex and systemic decision problems because, among other things, aid to define the problem to solve and to consider an immense amount of alternatives that in other forms would be very difficult to work with.

|